People will learn about its full use, financial limits, and who can claim it. · while sections 80c, 80ccc, and section 80ccd (1) provide tax benefits for an individual’s own contributions to various schemes including nps, section 80ccd (2) deals specifically with the tax treatment of the employer’s contribution to an employee’s national pension system (nps) account. This question is for testing whether you are a human visitor and to prevent automated spam submission. Please note that if your branch has provided the internet banking preprinted kit, you need not register online. The process of updating gst status (‘waiting for onfirmation/no response from ank’) for successful bank transactions by saral /retail users, is advised as under the process of updating gst status (‘waiting for confirmation/no response from bank’) for successful bank transactions by saral /retail users, is advised as under: What is section 80ccd(2)? By clicking on continue to login button, you agree to the terms of service (terms & conditions) of usage of internet banking of sbi. For customers using our sbi internet banking, all visitor information is collected along with any information that you volunteer as a customer while using sbis web site. · section 80ccd relates to the tax deduction for the contributions made in the national pension system (nps) and the atal pension yojana (apy). · under section 80 of the income tax act, 1961, an individual can avail exemptions and deductions that lowers their tax liability. What code is in the image? An alert message in the login page advises you to use the credentials in the preprinted kit (ppk) to login to internet banking. A complete guide on section 80ccd(2) of income tax act. Section 80ccd (2) applies to only salaried individuals and not to self-employed individuals. Customers using sbis internet banking service : Under section 80ccd, personal and employer contributions made to specific government pension schemes … · section 80ccd(2) of the income tax act offers a key tax deduction opportunity for contributions to the national pension system (nps). Contribution made by employer to nps scheme can be allowed as a deduction u/s 80ccd (2) of the income tax act. Also find out the deduction under section 80ccd(2) for fy 2025 - 26 & ay 2026 - 27 from goodreturns. State bank of india Under this section, you can claim a deduction of up to ₹2 lakh in a financial year (apart from the employer’s contribution, as detailed below). Tf_tran_617 contact us | privacy statement An employer can make contributions towards nps in addition to those made towards ppf and epf. Section 80ccd(2) pertains to the tax deduction available on the employer’s contribution to an employee’s nps account. Your support id is:

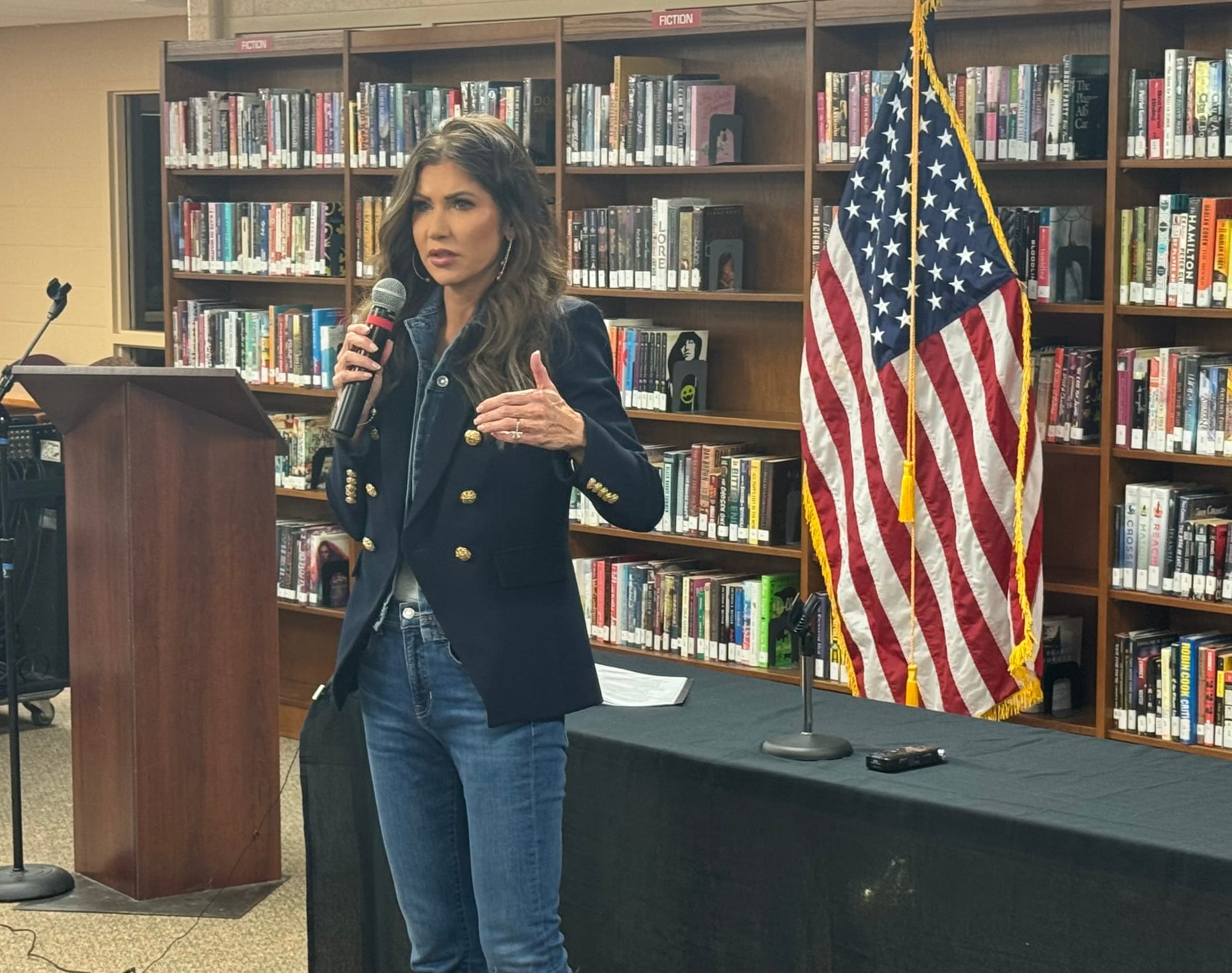

Kristi Noem'S Family And The Politics Of South Dakota

People will learn about its full use, financial limits, and who can claim it. · while sections 80c, 80ccc, and section 80ccd (1) provide tax...